Netflix (NASDAQ: NFLX ) is no longer a pushover when it comes to original shows, and now it's hoping to do the same thing with full-length features.

When Crouching Tiger, Hidden Dragon: The Green Legend hits theater audiences next summer it will also simultaneously be available on Netflix's streaming platform. The sequel to Ang Lee's critically acclaimed Crouching Tiger, Hidden Dragon will have some of the original movie's stars, but it won't have Lee in the directing chair. It also won't have traditional multiplex support.

One wouldn't expect exhibitors to rally around a movie that is available at home for no additional cost to Netflix's more than 50 million streaming accounts. The theatrical release next August is limited to IMAX (NYSE: IMAX ) and its more than 800 supersized screens worldwide. It won't be the last time that we see this happen, as Netflix and IMAX are teaming up for "several major films" that will be financially backed by Netflix.

Why is Netflix doing this? Won't it upset studio partners and multiplex operators? Will the math work (these movies aren't cheap)? Let's offer up a few possible reasons for this tie-up.

1. Netflix told you this was coming

This isn't a surprise to anyone paying attention. Netflix content chief Ted Sarandos turned heads last October in a keynote speech to the 2013 Film Independent Forum.

Why not premiere movies on Netflix, the same day that they're opening in theaters? And not little movies. There's a lot of people and a lot of ways to do that. Why not big movies?

The comment about "little movies" could have been a knock on Amazon.com (NASDAQ: AMZN ) , which has provided financing for low-budget indie fare in the past. Either way, it was a clear indication that this is where Netflix was heading.

2. There's value in prolific features

Netflix has embraced the initially derisive "rerun TV" tag that some have used to portray the streaming platform as a final resting place for old shows. That might be true, but Netflix knows that there's money to be made and subscribers to retain by offering binge streaming of several seasons of a particular show. This birthed the original programming movement that has delivered the goods through House of Cards, Orange Is the New Black, and other Netflix exclusives.

However, Netflix knows that movies are also a big deal. There's a reason why folks are willing to pay an average of $8.15 per ticket to see a flick at the theater. Despite being a much costlier production per minute of eventual content, there are times when a group of people fire up Netflix and don't want to have to worry about everybody being on the same episode of a certain show. A movie solves that dilemma, giving viewers a complete meal in roughly two hours.

3. First-run movies can open the door on pay-per-view

Netflix streaming subscribers are paying just $7.99 -- $8.99 for new users -- a month. That has always seemed like a pretty good deal, and it's why Netflix has been able to quickly surpass 50 million subs worldwide.

It works. Revenue moved 37% higher in its latest quarter, with profitability more than doubling.

What do you think will happen to the value proposition of a Netflix subscription once the Crouching Tiger, Hidden Dragon sequel hits IMAX screens next August? After all, a ticket to that sensory experience will cost more than an entire month of Netflix.

Netflix knows that it has some degree of pricing elasticity. It kicked in a springtime rate increase for new members and still managed to grow its installed base nicely. Could we someday reach a time when Netflix can charge for some of these new releases -- at least in their initial run -- in addition to the subscription? Amazon already does this, and it has a larger catalog of pay titles than those it makes available to Amazon Prime members at no additional cost.

Netflix apparently won't charge customers extra next summer. However, that will be an option if these screenings prove successful.

Your cable company is scared, but you can get rich

You know cable's going away. But do you know how to profit? There's $2.2 trillion out there to be had. Currently, cable grabs a big piece of it. That won't last. And when cable falters, three companies are poised to benefit. Click here for their names. Hint: One of them is not Netflix.

Mel Evans/APNew home construction is seen as a laggard among forecasters. Economists see steady growth but remain mixed on their outlook for the health of different segments of the U.S. economy. Investments by businesses and government, as well as international trade activity, will grow at a faster rate than previously forecast, according to a survey released Monday by the National Association for Business Economics. However, consumer spending and investments in homes will be lower than previously predicted because of Americans' lagging wage growth and trouble obtaining loans. The predictions come in a quarterly survey of 46 forecasters that was conducted between Aug. 25 and Sept. 9. Following an unusually high degree of volatility in the first half of the year, the group expects the pace of economic growth to steady, with gross domestic production forecast to grow at a seasonally adjusted annualized rate of 3 percent in the third and fourth quarters of 2014 and throughout 2015.

Mel Evans/APNew home construction is seen as a laggard among forecasters. Economists see steady growth but remain mixed on their outlook for the health of different segments of the U.S. economy. Investments by businesses and government, as well as international trade activity, will grow at a faster rate than previously forecast, according to a survey released Monday by the National Association for Business Economics. However, consumer spending and investments in homes will be lower than previously predicted because of Americans' lagging wage growth and trouble obtaining loans. The predictions come in a quarterly survey of 46 forecasters that was conducted between Aug. 25 and Sept. 9. Following an unusually high degree of volatility in the first half of the year, the group expects the pace of economic growth to steady, with gross domestic production forecast to grow at a seasonally adjusted annualized rate of 3 percent in the third and fourth quarters of 2014 and throughout 2015.

Reuters

Reuters  Scott Roth, Invision/APFormer New York City Mayor Michael Bloomberg NEW YORK -- Former Mayor Michael Bloomberg is returning to lead the financial data and news company he founded in 1981 but left to serve three terms in City Hall. The company, Bloomberg LP, said Wednesday that current CEO Daniel Doctoroff will step down at the end of the year. Doctoroff was a deputy mayor under Bloomberg. His departure makes way for Bloomberg to take back the helm of the company, of which he still owns more than 85 percent. The 72-year-old Bloomberg handed the reins of America's largest city to Bill de Blasio on Jan. 1. In a statement, Bloomberg said he never intended to return to his company after 12 years as mayor. But after reacquainting with its operations, he said, he couldn't resist its lure. "I have gotten very involved in the company again and that led to Dan coming to me recently to say he thought it would be best for him to turn the leadership of the company back to me," said Bloomberg, whose company has grown to employ more than 15,000 people in 73 countries and has made him a billionaire. Doctoroff joined Bloomberg LP in 2008 and became CEO in July 2011. Before that he served six years as Bloomberg's deputy mayor for economic development. He said he had no job lined up but in the short term would focus on his not-for-profit interests. Bloomberg, whose fortune Forbes estimates at $33.2 billion, credited Doctoroff with guiding the company through the financial crisis of 2008 and the deep recession that followed. Bloomberg LP is privately held and isn't obliged to divulge financial information, but it said Wednesday that its revenue grew to more than $9 billion this year from $5.4 billion in 2007. Its subscribers have grown to 321,000 from 273,000, it said, while it added more than 500 reporters and editors.

Scott Roth, Invision/APFormer New York City Mayor Michael Bloomberg NEW YORK -- Former Mayor Michael Bloomberg is returning to lead the financial data and news company he founded in 1981 but left to serve three terms in City Hall. The company, Bloomberg LP, said Wednesday that current CEO Daniel Doctoroff will step down at the end of the year. Doctoroff was a deputy mayor under Bloomberg. His departure makes way for Bloomberg to take back the helm of the company, of which he still owns more than 85 percent. The 72-year-old Bloomberg handed the reins of America's largest city to Bill de Blasio on Jan. 1. In a statement, Bloomberg said he never intended to return to his company after 12 years as mayor. But after reacquainting with its operations, he said, he couldn't resist its lure. "I have gotten very involved in the company again and that led to Dan coming to me recently to say he thought it would be best for him to turn the leadership of the company back to me," said Bloomberg, whose company has grown to employ more than 15,000 people in 73 countries and has made him a billionaire. Doctoroff joined Bloomberg LP in 2008 and became CEO in July 2011. Before that he served six years as Bloomberg's deputy mayor for economic development. He said he had no job lined up but in the short term would focus on his not-for-profit interests. Bloomberg, whose fortune Forbes estimates at $33.2 billion, credited Doctoroff with guiding the company through the financial crisis of 2008 and the deep recession that followed. Bloomberg LP is privately held and isn't obliged to divulge financial information, but it said Wednesday that its revenue grew to more than $9 billion this year from $5.4 billion in 2007. Its subscribers have grown to 321,000 from 273,000, it said, while it added more than 500 reporters and editors. Susye Greenwood, a customer at New York's Fresco, tips $1 for her server via a swipe of her card in the DipJar. NEW YORK (CNNMoney) The tip jar at coffee shops is often an embarrassment for the kind of people who pay for everything with their credit cards and rarely have small change on hand.

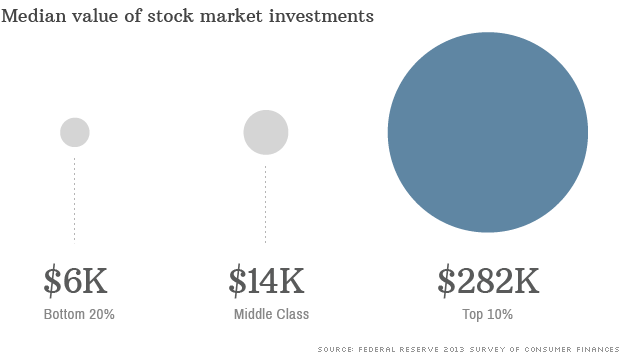

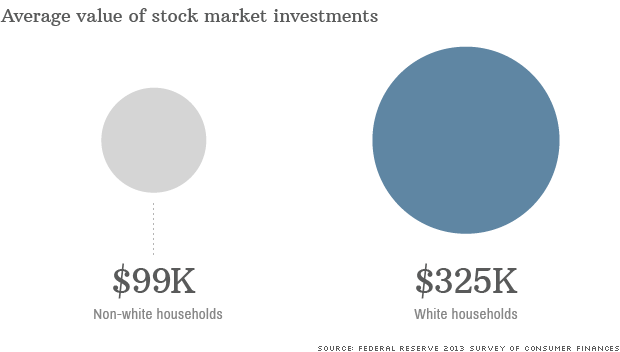

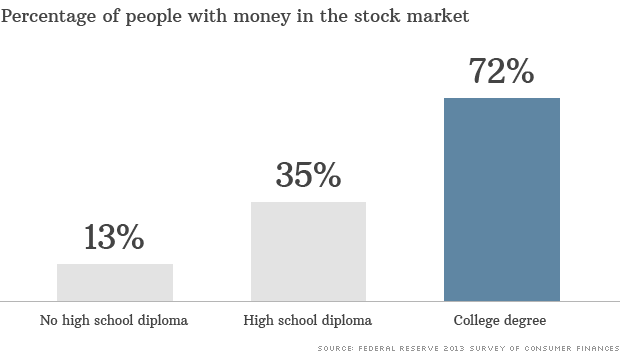

Susye Greenwood, a customer at New York's Fresco, tips $1 for her server via a swipe of her card in the DipJar. NEW YORK (CNNMoney) The tip jar at coffee shops is often an embarrassment for the kind of people who pay for everything with their credit cards and rarely have small change on hand.  Only 49% of Americans own stocks. NEW YORK (CNNMoney) The United States is enjoying one of the best stock market surges in its history. But the phenomenal gains in recent years are going mostly to white, college-educated individuals who are already pretty well off.

Only 49% of Americans own stocks. NEW YORK (CNNMoney) The United States is enjoying one of the best stock market surges in its history. But the phenomenal gains in recent years are going mostly to white, college-educated individuals who are already pretty well off.

REUTERS

REUTERS  Patrick T. Fallon/Bloomberg via Getty ImagesGeneral Electric appliances at a Lowe's store in Torrance, California. NEW YORK -- General Electric (GE), a household name for more than a century in part for making households easier to run, is leaving the home. The company is selling the division that invented the toaster in 1905 and now sells refrigerators, stoves and laundry machines. GE has increasingly focused on building industrial machines such as aircraft engines, locomotives, gas-fired turbines and medical imaging equipment -- much bigger and more complex than washers, and more profitable. "They are no longer going to be a consumer company," says Andrew Inkpen, a professor at the Thunderbird School of Global Management who has written extensively about GE. GE, based in Fairfield, Connecticut, announced Monday the sale of its appliance division to the Swedish appliance-maker Electrolux for $3.3 billion. Electrolux will still sell appliances under the GE brand in attempt to leverage the company's long history. GE has sold devices to people for its entire 122-year history, starting with the light bulb, which was invented by company founder Thomas Edison. The lighting division will stay, but it's just a tiny part of GE. Now GE will sell its products almost exclusively to other companies. The company is hoping to return to favor among investors with higher, more consistent and more predictable profits. GE is the only remaining member of the Dow Jones industrial average (^DJI), first calculated in 1896, and as recently as 2004 it was the biggest corporation in the world by market value. But GE has frustrated shareholders by underperforming both the Dow and broader stock indexes for much of the last decade. The company has been able to survive by shuffling its portfolio to shed unprofitable divisions or jump into a new, growing sector. And it has never shied away from abandoning historic businesses, like the plastics unit it started in 1912 and sold in 2007. The latest version of GE will make mostly big, complex equipment, some of which it has been making for more than a century, like power generators, and some that is new to GE, like oil and gas drilling equipment. In July the company spun off its consumer credit card business into a new company, Synchrony Financial. In recent years it has sold NBC Universal and its insurance operations and it is gradually shrinking its sprawling financial company, called GE Capital. In June GE agreed to buy the energy and power generation operations of the French engineering company Alstom for $17 billion. And over the last several years it has been acquiring companies to help it become a bigger player in oil and gas drilling equipment. Christopher Glynn, an analyst at Oppenheimer & Co., says the company now has the potential to show the strong results it was once famous for, though it still may take some time. "It's still GE, it's still huge," he says. "But this is a viable reset."

Patrick T. Fallon/Bloomberg via Getty ImagesGeneral Electric appliances at a Lowe's store in Torrance, California. NEW YORK -- General Electric (GE), a household name for more than a century in part for making households easier to run, is leaving the home. The company is selling the division that invented the toaster in 1905 and now sells refrigerators, stoves and laundry machines. GE has increasingly focused on building industrial machines such as aircraft engines, locomotives, gas-fired turbines and medical imaging equipment -- much bigger and more complex than washers, and more profitable. "They are no longer going to be a consumer company," says Andrew Inkpen, a professor at the Thunderbird School of Global Management who has written extensively about GE. GE, based in Fairfield, Connecticut, announced Monday the sale of its appliance division to the Swedish appliance-maker Electrolux for $3.3 billion. Electrolux will still sell appliances under the GE brand in attempt to leverage the company's long history. GE has sold devices to people for its entire 122-year history, starting with the light bulb, which was invented by company founder Thomas Edison. The lighting division will stay, but it's just a tiny part of GE. Now GE will sell its products almost exclusively to other companies. The company is hoping to return to favor among investors with higher, more consistent and more predictable profits. GE is the only remaining member of the Dow Jones industrial average (^DJI), first calculated in 1896, and as recently as 2004 it was the biggest corporation in the world by market value. But GE has frustrated shareholders by underperforming both the Dow and broader stock indexes for much of the last decade. The company has been able to survive by shuffling its portfolio to shed unprofitable divisions or jump into a new, growing sector. And it has never shied away from abandoning historic businesses, like the plastics unit it started in 1912 and sold in 2007. The latest version of GE will make mostly big, complex equipment, some of which it has been making for more than a century, like power generators, and some that is new to GE, like oil and gas drilling equipment. In July the company spun off its consumer credit card business into a new company, Synchrony Financial. In recent years it has sold NBC Universal and its insurance operations and it is gradually shrinking its sprawling financial company, called GE Capital. In June GE agreed to buy the energy and power generation operations of the French engineering company Alstom for $17 billion. And over the last several years it has been acquiring companies to help it become a bigger player in oil and gas drilling equipment. Christopher Glynn, an analyst at Oppenheimer & Co., says the company now has the potential to show the strong results it was once famous for, though it still may take some time. "It's still GE, it's still huge," he says. "But this is a viable reset."