Investors hoping to take advantage of the planned Five Below (NASDAQ: FIVE ) secondary share issue will have to wait for another day. The company announced that, "in light of current capital market conditions," the offering has been postponed; it did not specify whether it has been rescheduled.

A group of selling shareholders, including members and associates of the firm's management team and board of directors, were to offer just over 8.56 million shares in the underwritten issue. Additionally, it was expected that the company's underwriters were to be granted a 30-day purchase option for up to an additional 1.28 million shares.

In the press release originally heralding the sale, Five Below stressed it is not to receive any monies from the offering, as it is not the selling party.

The joint book-running managers of the offering are Goldman Sachs (NYSE: GS ) , Barclays' (NYSE: BCS ) Capital unit, Leucadia's Jefferies, and the Securities arms of Credit Suisse (NYSE: CS ) and Deutsche Bank (NYSE: DB ) .

Top 10 High Tech Companies To Buy Right Now: WSFS Financial Corporation(WSFS)

WSFS Financial Corporation operates as the thrift holding company for the Wilmington Savings Fund Society, FSB, which provides various financial services primarily in the mid-Atlantic region of the United States. It accepts a range of deposit products, including savings accounts, demand deposits, interest-bearing demand deposits, money market deposit accounts, and certificates of deposits, as well as jumbo certificates of deposit. The company?s loan portfolio comprises residential mortgage loans; residential real estate loans; nonresidential real estate loans; real estate mortgage loans; commercial construction loans; commercial lending that includes loans for the purpose of working capital, financing equipment acquisitions, business expansion, and other business purposes; consumer credit products that primarily comprise home improvement loans, home equity lines of credit, automobile loans, unsecured lines of credit, and other secured and unsecured personal installment lo ans. It also offers a range of trust and wealth management services. The company, through its other subsidiaries, markets various third-party investment and insurance products, such as single-premium annuities, whole life policies, and securities; and provides investment advisory services to high net-worth individuals and institutions. As of October 3, 2011, it operated 49 banking offices, including 39 in Delaware, 8 in Pennsylvania, 1 in Virginia, and 1 in Nevada. The company was founded in 1832 and is headquartered in Wilmington, Delaware.

Top 10 High Tech Companies To Buy Right Now: Zoommed Inc. (ZMD.V)

ZoomMed Inc. and its subsidiaries engage in the development and marketing of various computer applications for healthcare professionals in Canada. The company develops the ZRx Prescriber, a Web application that runs on smart phones, wireless devices or computers allowing physicians to write a bar-coded prescription enabling pharmacists to access and retrieve script information online. It builds and operates e-Pic Communication Network, a clinical information exchange platform between physicians and various other stakeholders of the healthcare sector, such as pharmacists, specialists, pharmaceutical corporations, laboratories, specialized clinics, employers, and others. The company also offers PraxisLab pharmacy management software, which enhances various aspects of the prescription filling process and pharmacists patient file management. It serves physicians, pharmacists, patients, pharmaceutical companies, and private labs. ZoomMed Inc. was incorporated in 2005 and is hea dquartered in Brossard, Canada.

Axia NetMedia Corporation provides broadband Internet services and solutions through its Next Generation Networks (NGNs). It offers Real Broadband services that exchange amounts of audio, data, and video with connectivity levels. The company operates various NGNs, including the Alberta SuperNet, an open access network connecting 429 communities in Alberta; Covage NGN consists of 14 early stage active networks in France; Xarxa Oberta, which connects 696 Generalitat sites in the fields of health, education, justice, and safety in Catalonia; OpenNet, an open access NGN broadband network to provide fibre and access to broadband services in Singapore; and MassBroadband 123 fibre network connecting approximately 120 communities in western and north central Massachusetts. It also offers various networking services comprising bandwith services and NGN enabling services. The company serves customers primarily in the government, health, education, business, industrial, and municipal ity sectors, as well as service providers. Axia NetMedia Corporation was founded in 1994 and is headquartered in Calgary, Canada.

Top 10 High Tech Companies To Buy Right Now: Maxim Power Corp Com Npv (MXG.TO)

Maxim Power Corp., an independent power producer, engages in the acquisition, development, ownership, and operation of power generation facilities, as well as sale of electricity and heat. The company primarily generates electricity through coal, natural gas, waste heat, and landfill gas fuelled cogeneration facilities. It owns and operates 40 power plants with 788 megawatts (MW) of electric and 111 MW of thermal net generating capacity in western Canada, the United States, and France. The company is based in Calgary, Canada.

Top 10 High Tech Companies To Buy Right Now: Csr Ord 0.1p(CSR.L)

CSR plc, a fabless semiconductor company, designs and develops semiconductors and software based solutions in the United Kingdom, rest of Europe, the Americas, and Asia. It offers multifunction semiconductor platforms for the auto, camera, low energy connectivity, document imaging, and wireless voice and music markets; and semiconductors for the handset and other consumer electronics markets. The company?s technology portfolio comprises Bluetooth and Bluetooth SMART; global positioning system (GPS) and global navigation satellite systems location products; frequency modulated radio; Wi-Fi or wireless fidelity; audio and associated codec; near-field communication, a short range wireless technology that enables the transfer of data and secure transactions between devices; and imaging and video processing technologies. Its technologies have applications in a range of mobile consumer devices, such as handsets, tablets, automotive infotainments systems, personal navigation dev ices, wireless headsets, wireless audio systems, personal computers, GPS recreational devices, tracking and logistics management systems, digital cameras, printers, digital televisions, and gaming devices. The company markets its products to original equipment manufacturers and original design manufacturers primarily through its direct sales force and sales representatives, as well as through a network of distributors. It has operations in the United Kingdom, the United States, China, Taiwan, South Korea, Israel, Japan, and Singapore. CSR plc was founded in 1999 and is headquartered in Cambridge, the United Kingdom.

Top 10 High Tech Companies To Buy Right Now: Akela Pharma Inc He Company] (AKL.TO)

Akela Pharma, Inc. operates as a specialty contract pharmaceutical formulation developer in the United States. It offers contract pharma services comprising formulation and process development of drug in tablets, capsules, multiparticulates, fast formulations, oral and topical liquids, powders for suspension/reconstitution, and semi-solid forms. The company also provides analytical services, which include research and development analytical testing and support for formulation development; analytical method development and phase-appropriate validation; quality control testing for API and raw materials release; and stability testing and ICH compliant stability storage. In addition, it offers drug delivery solutions, such as hot melt extrusion for amorphous dispersions, spray-drying for amorphous dispersions, controlled release dosage forms, liquid solutions (encapsulated and bottled), and novel dosage forms, as well as beads, granulation, and drug layering services. Further, the company�s contract services consist of handling of potent compounds; pharmaceutical patent litigation support services; GMP clinical and commercial manufacturing; clinical labeling and packaging; and IP validation and contestation consulting services. The company was formerly known as LAB International Inc. and changed its name to Akela Pharma, Inc. in June 2007. Akela Pharma, Inc. was founded in 1979 and is headquartered in Austin, Texas.

Top 10 High Tech Companies To Buy Right Now: Audiovox Corporation(VOXX)

VOXX International Corporation provides automotive and consumer electronic products, and accessories in the United States and internationally. The company?s products include mobile multimedia systems; auto sound systems comprising satellite radio, vehicle security, and remote start systems; portable DVD players; and personal and vehicle tracking devices. It also offers consumer electronics products, such as personal sound amplifiers, MP3 players, digital camcorders, docking stations, digital voice recorders, clock radios, digital picture frames, and home stereos; consumer electronics accessories comprising digital antennas, remote controls, wireless solutions, headphones, HDMI cables, power solutions, and media cleaning and care; and car audio and video products. In addition, the company provides audio products consisting of home theater systems; indoor and outdoor speaker lines; surround sound systems; sub woofers; professional installation products, such as cinema speake rs; and personal audio products, which include iPod docking stations and computer speakers. It markets its products under the Klipsch, RCA, Invision, Jensen, Audiovox, Terk, Acoustic Research, Advent, Code Alarm, CarLink, Omega, Excalibur, Prestige, SURFACE, Jamo, Energy, Mirage, Mac Audio, Magnat, Heco, Schwaiger, Oehlbach, and Incaar brands through a network of power retailers, mass merchandisers, hardware and independent retailers, 12-volt specialists, military exchanges, and automotive manufacturers, as well as through Internet. The company was formerly known as Audiovox Corporation and changed its name to VOXX International Corporation in December, 2011. VOXX International Corporation was founded in 1965 and is headquartered in Hauppauge, New York.

Advisors' Opinion: - [By Seth Jayson]

VOXX International (Nasdaq: VOXX ) reported earnings on May 14. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended Feb. 28 (Q4), VOXX International beat slightly on revenues and beat expectations on earnings per share.

- [By Seth Jayson]

VOXX International (Nasdaq: VOXX ) is expected to report Q1 earnings on July 10. Here's what Wall Street wants to see:

The 10-second takeaway

Comparing the upcoming quarter to the prior-year quarter, average analyst estimates predict VOXX International's revenues will shrink -2.4% and EPS will decrease -69.2%.

- [By Monica Gerson]

VOXX International (NASDAQ: VOXX) is projected to post its Q2 earnings at $0.09 per share on revenue of $186.73 million.

RPM International (NYSE: RPM) is expected to report its Q1 earnings at $0.71 per share on revenue of $1.13 billion.

Top 10 High Tech Companies To Buy Right Now: Honeywell Intl Inc(HON.L)

Honeywell International Inc. operates as a diversified technology and manufacturing company worldwide. Its Aerospace segment provides turbine propulsion engines, auxiliary power units, environmental control and electric power systems, engine systems and accessories, avionic systems, aircraft lighting, inertial sensors, control products, space products and subsystems, and landing products for aircraft manufacturers, airlines, business and general aviation, military, space, and airport operations, as well as offers management and technical, logistics, aircraft wheels and brakes and repair, and overhaul services. The company?s Automation and Control Solutions segment provides environmental and combustion controls, and sensing controls; security and life safety products and services; scanning and mobility products; process automation products and solutions; and building solutions and services for homes, buildings, and industrial facilities. Its Performance Materials and Techn ologies segment provides resins and chemicals; hydrofluoric acid; fluorocarbons; nuclear services; research and fine chemicals; performance chemicals; chemical processing sealants; fibers and composites; specialty films and additives; imaging and electronic chemicals; semiconductor materials and services; catalysts, adsorbents, and specialties; and renewable fuels and chemicals. It offers products for applications in the refining, petrochemical, automotive, healthcare, agricultural, packaging, refrigeration, appliance, housing, semiconductor, wax, and adhesives segments. This segment also provides process technology and equipment for the petroleum refining, and petrochemical and gas processing industries. The company?s Transportation Systems segment provides charge-air systems; thermal systems; and brake hard parts and other friction materials for passenger cars and commercial vehicles. Honeywell International Inc. was founded in 1920 and is headquartered in Morris Township , New Jersey.

Top 10 High Tech Companies To Buy Right Now: Novellus Systems Inc.(NVLS)

Novellus Systems, Inc., together with its subsidiaries, develops, manufactures, sells, and supports equipment used in the fabrication of integrated circuits. The company operates in two segments, Semiconductor Group and Industrial Applications Group. The Semiconductor Group segment provides equipment used in wafer processing, advanced wafer-level packaging, and light-emitting diode (LED) manufacturing. Its deposition systems use chemical vapor deposition (CVD), physical vapor deposition (PVD), and electrochemical deposition (ECD) processes to form transistor, capacitor, and interconnect layers in an integrated circuit; and High-Density Plasma CVD (HDP-CVD) and Plasma-Enhanced CVD (PECVD) systems employ chemical plasma to deposit dielectric material within the gaps formed by the etching of aluminum, or as a blanket film that can be etched with patterns for depositing conductive materials into the etched dielectric. This segment?s CVD Tungsten systems are used to deposit co nductive contacts between transistors and interconnects; PVD systems are used to deposit conductive aluminum and copper metal layers by sputtering metal atoms; and Electrofil ECD systems are used for depositing copper to form the conductive wiring on integrated circuits using copper interconnects. The Industrial Applications Group segment provides grinding, lapping, and polishing equipment for fine-surface optimization. It offers products for use in the semiconductor and LED manufacturing, automotive, aerospace, medical, green energy, and glass and ceramics industries, as well as manufacturers of products, such as pumps, transmissions, compressors, and bearings. The company markets its products through direct sales force and manufacturer?s representatives primarily in Europe, the United States, Korea, Japan, China, Taiwan, and southeast Asia. Novellus Systems, Inc. was founded in 1984 and is headquartered in San Jose, California.

Top 10 High Tech Companies To Buy Right Now: Flotek Industries Inc (FTK)

Flotek Industries, Inc. (Flotek), incorporated on May 17, 1985, is a diversified global supplier of drilling and production related products and services. Its core focus is oilfield specialty chemicals and logistics, down-hole drilling tools and down-hole production tools used in the energy and mining industries. Flotek operates in three segments: Chemicals and Logistics, Drilling Products and Artificial Lift. The Company operates using third party agents in Canada, Mexico, Central America, South America, the Middle East, and Asia. In May 2013, Flotek Industries Inc through its wholly owned subsidiary acquired the entire share capital of Florida Chemical Co Inc.

Chemicals and Logistics

The chemical business provides oil and natural gas field specialty chemicals for use in drilling, cementing, stimulation and production activities. The Company�� specialty chemicals are manufactured to withstand a range of down-hole pressures, temperatures and other well-specific conditions. Flotek operates two laboratories, a technical services laboratory and a research and development laboratory, which focus on design, development and testing of new chemical formulations and enhancement of existing products, often in cooperation with the customers. Its micro-emulsions are stable mixtures of oil, water and surface active agents, forming complex nano-fluids, in which the molecules are organized into nanostructures. The micro-emulsions are composed of renewable plant derived cleaning ingredients and oils and are biodegradable. Flotek�� logistics business designs, project manages and operates automated bulk material handling and loading facilities. These bulk facilities handle oilfield products, including sand and other materials for well-fracturing operations, dry cement and additives for oil and gas well cementing, and supply materials used in oilfield operations.

Drilling Products

Flotek is a provider of down-hole drilling tools used in the oilfield, min! ing, water-well and industrial drilling activities. It manufactures, sells, rents and inspects specialized equipment for use in drilling, completion, and production and workover activities. The rental tools include stabilizers, drill collars, reamers, wipers, jars, shock subs, wireless survey, and measurement while drilling (MWD) tools and mud-motors. Equipment sold primarily includes mining equipment, centralizers and drill bits. Flotek focuses its product marketing primarily in the Southeast, Northeast, Mid-Continent and Rocky Mountain regions of the United States, with international sales conducted through third party agents.

Artificial Lift

Flotek provides pumping system components, electric submersible pumps (ESPs), gas separators, production valves and services. The products address the needs of coal bed methane and traditional oil and gas production to move gas, oil and other fluids from the producing horizon to the surface. The Artificial Lift products employ technologies to improved performance. The Petrovalve product optimizes pumping efficiency in horizontal completions, heavy oil and wells with high liquid to gas ratios. Artificial Lift products are manufactured in China, assembled domestically and distributed globally.

Advisors' Opinion: - [By David Smith]

Flotek Industries (NYSE: FTK )

The smallest member of the trio, with a market cap of about $815 million, Flotek operates on the services side of the energy sector. As I've previously pointed out to Fools, it also constitutes a rare instance wherein the analysts who monitor the company all accord it strong buy ratings. But with Flotek's share price having risen by more than 40% year to date, it is difficult to contest that unanimous confidence.

- [By David Smith]

Flotek Industries (NYSE: FTK )

I've mentioned Flotek Industries to Fools in the past. The relatively small ($940 million capitalization and growing) company provides a range of products and assistance for oil and gas operations, from well construction to production. It's also the only services company -- and one of but a handful of companies in any sector -- that's been accorded a perfect consensus of one (strong buy) by the analysts.

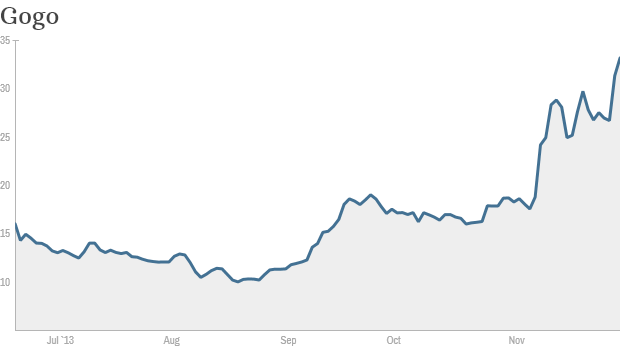

Gogo CEO promises faster plane Wi-Fi

Gogo CEO promises faster plane Wi-Fi ![]()

) looks for a new CEO to replace Steve Ballmer, there is now one less in-house prospect, as Blaise Aguera y Arcas has left the company to join Google.

) looks for a new CEO to replace Steve Ballmer, there is now one less in-house prospect, as Blaise Aguera y Arcas has left the company to join Google.