In my early days as a dividend growth investor, I focused exclusively on the list of dividend aristocrats. It included 50 or so solid blue chips, each of which had managed to boost dividends for at least a quarter of a century. I liked the fact that this was a short list, which made screening for potential candidates for inclusion in my portfolio very easy.

As I kept digging however, I learned more about the historical changes in the S&P Dividend Aristocrats Index. I was very surprised to learn that some companies had been eliminated from the index, despite the fact that they kept increasing distributions. I also noticed that there were many companies which had raised dividends for over 25 years in a row, yet they were never included in the index, for whatever strange reason. Luckily, I had found the dividend champions lists, maintained by David Fish. While his list is as complete as possible, I would still advise income investors to get their hands dirty with as much information as possible, before eliminating an idea from their list for further research due to a low streak of consecutive dividend increases.

Top 10 Blue Chip Stocks To Invest In 2014: Apple Inc.(AAPL)

Apple Inc., together with subsidiaries, designs, manufactures, and markets personal computers, mobile communication and media devices, and portable digital music players, as well as sells related software, services, peripherals, networking solutions, and third-party digital content and applications worldwide. The company sells its products worldwide through its online stores, retail stores, direct sales force, third-party wholesalers, resellers, and value-added resellers. In addition, it sells third-party Mac, iPhone, iPad, and iPod compatible products, including application software, printers, storage devices, speakers, headphones, and other accessories and peripherals through its online and retail stores; and digital content and applications through the iTunes Store. The company sells its products to consumer, small and mid-sized business, education, enterprise, government, and creative markets. As of September 25, 2010, it had 317 retail stores, including 233 stores in the United States and 84 stores internationally. The company, formerly known as Apple Computer, Inc., was founded in 1976 and is headquartered in Cupertino, California.

Advisors' Opinion: - [By Daniel Sparks]

Analysts expect Apple (NASDAQ: AAPL ) to report revenue of $35.02 billion for the company's third quarter, according to Fortune's preliminary survey. As Fortune's Philip Elmer-DeWitt points out, that's the exact same number Apple reported in the year-ago quarter. Is zero growth Apple's new norm? Or, even worse, is decline Apple's future? Possibly -- but there are still a few potential growth drivers left for Cupertino's tech giant.

- [By Andrew Tonner]

Shares of Apple (NASDAQ: AAPL ) are limping into the second part of the calendar year, a period that is critically important for the company. As is typically the case, investors and consumers expect Apple to have some very big items in its product portfolio both in the short term and long term. So what's most likely to hit the market in the next six months, and what could that potentially mean for Apple and its investors? Fool contributor Andrew Tonner weighs in on some of the biggest Apple storylines to watch for during the rest of the year.

- [By Doug Ehrman]

Recently both BGR�and MacRumors�reported on what are alleged to be leaked pictures of the new Apple (NASDAQ: AAPL ) iPhone 5S, expected to be released later this fall. If the pictures are legitimate, while much of the functionality remains uncertain, it is clear that the newest member of the iPhone family will be the same size as the iPhone 5. Given a recent report by Fast Company�-- outlining that screen size is one of the three most important features as reported by consumers -- the failure by Apple to make the screen bigger should be of concern to investors.

Top 10 Blue Chip Stocks To Invest In 2014: Philip Morris International Inc(PM)

Philip Morris International Inc., through its subsidiaries, engages in the manufacture and sale of cigarettes and other tobacco products in markets outside of the United States. Its international product brand line comprises Marlboro, Merit, Parliament, Virginia Slims, L&M, Chesterfield, Bond Street, Lark, Muratti, Next, Philip Morris, and Red & White. The company also offers its products under the A Mild, Dji Sam Soe, and A Hijau in Indonesia; Diana in Italy; Optima and Apollo-Soyuz in the Russian Federation; Morven Gold in Pakistan; Boston in Colombia; Belmont, Canadian Classics, and Number 7 in Canada; Best and Classic in Serbia; f6 in Germany; Delicados in Mexico; Assos in Greece; and Petra in the Czech Republic and Slovakia. It operates primarily in the European Union, Eastern Europe, the Middle East, Africa, Asia, Canada, and Latin America. The company is based in New York, New York.

Advisors' Opinion: - [By Shauna O'Brien]

On Wednesday, Philip Morris International Inc. (PM) announced that its board has approved a 10.6% increase to its quarterly dividend.

PM has increased its dividend from 85 cents to 94 cents per share, or $3.76 annually.

The dividend will be paid on October 11 to shareholders of record on September 26. The stock will go ex-dividend on September 24.

Philip Morris shares were mostly flat during pre-market trading Wednesday. The stock has been mostly flat YTD.

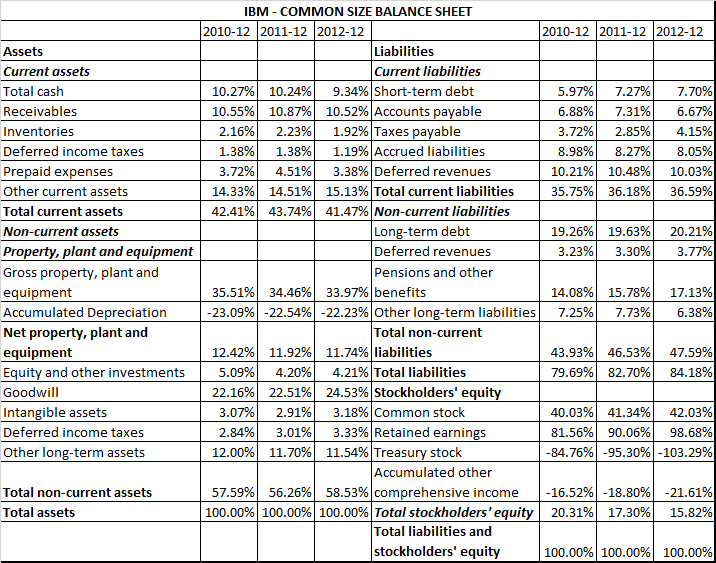

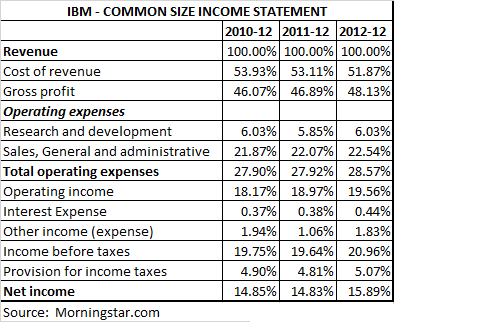

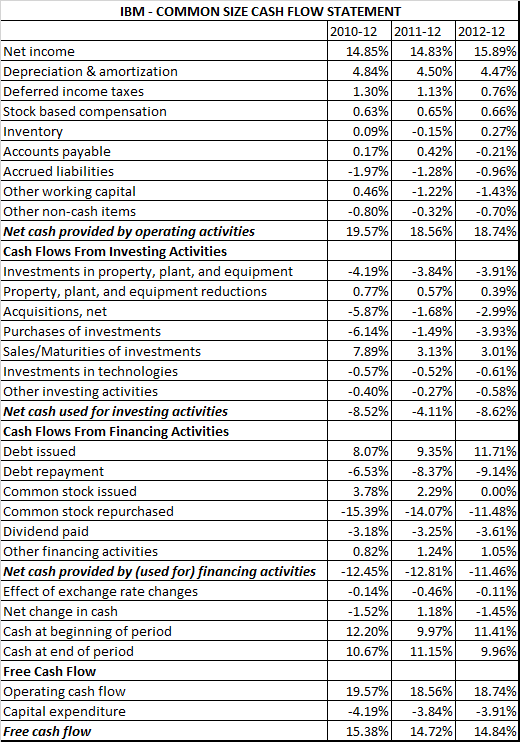

International Business Machines Corporation (IBM) provides information technology (IT) products and services worldwide. Its Global Technology Services segment provides IT infrastructure and business process services, including strategic outsourcing, process, integrated technology, and maintenance services, as well as technology-based support services. The company?s Global Business Services segment offers consulting and systems integration, and application management services. Its Software segment offers middleware and operating systems software, such as WebSphere software to integrate and manage business processes; information management software for database and enterprise content management, information integration, data warehousing, business analytics and intelligence, performance management, and predictive analytics; Tivoli software for identity management, data security, storage management, and datacenter automation; Lotus software for collaboration, messaging, and so cial networking; rational software to support software development for IT and embedded systems; business intelligence software, which provides querying and forecasting tools; SPSS predictive analytics software to predict outcomes and act on that insight; and operating systems software. Its Systems and Technology segment provides computing and storage solutions, including servers, disk and tape storage systems and software, point-of-sale retail systems, and microelectronics. The company?s Global Financing segment provides lease and loan financing to end users and internal clients; commercial financing to dealers and remarketers of IT products; and remanufacturing and remarketing services. It serves financial services, public, industrial, distribution, communications, and general business sectors. The company was formerly known as Computing-Tabulating-Recording Co. and changed its name to International Business Machines Corporation in 1924. IBM was founded in 1910 and is based in Armonk, New York.

Advisors' Opinion: - [By Matt Thalman]

Shares of IBM (NYSE: IBM ) are down 1.3% today, perhaps because of the disappointing fourth-quarter results Oracle (NYSE: ORCL ) posted yesterday. This is especially troubling because, as my colleague Alex Dumortier noted earlier today, the fourth quarter is historically Oracle's best in terms of sales. Investors may be concerned that this slowdown for Oracle will prove a trend for the� whole IT sector, includes Big Blue. Investors have been concerned about IBM growth prospects moving forward. The stock has struggled in 2013, rising only 1.85% year to date to make it the fourth-worst-performing Dow component of the year.

- [By Chris Hill]

Dollar General's (NYSE: DG ) first-quarter profits rose rose 3%, but the retailer cut guidance for the full year. Business market software maker ExactTarget (NYSE: ET ) rose more than 50% after Salesforce.com (NYSE: CRM ) agreed to buy the company for more than $2.3 billion. Zynga (NASDAQ: ZNGA ) held firm after shares tanked on Monday in the wake of the company announcing it's cutting 18% of its staff. And IBM (NYSE: IBM ) buys a company to better compete in the cloud computing space. In this installment of Investor Beat, our analysts discuss four stocks making big moves.

- [By Dan Caplinger]

One of Accenture's biggest areas of growth has been in technology-related consulting, with the company having become the No. 2 IT consulting company in the world, trailing only rival IBM (NYSE: IBM ) . Accenture's ability to take advantage of diversity in its employee ranks comes from its lack of a physical corporate headquarters, allowing employees to work in their home countries, and thereby attracting the most talented workers available in a given area. In particular, Accenture has focused much of its attention on India, with more than a quarter of its employees hailing from the subcontinent.

- [By Investometrica]

If there is a reason I hear a lot for investing in IBM (IBM) nowadays, it is the popular 'argument from authority' fallacy: "Warren Buffett owns 67 million shares. Therefore I should own the stock."

Top 10 Blue Chip Stocks To Invest In 2014: McDonald's Corporation(MCD)

McDonald?s Corporation, together with its subsidiaries, operates as a worldwide foodservice retailer. It franchises and operates McDonald?s restaurants that offer various food items, soft drinks, coffee, and other beverages. As of December 31, 2009, the company operated 32,478 restaurants in 117 countries, of which 26,216 were operated by franchisees; and 6,262 were operated by the company. McDonald?s Corporation was founded in 1948 and is based in Oak Brook, Illinois.

Advisors' Opinion: - [By Demitrios Kalogeropoulos]

With casual-dining rivals such as McDonald's (NYSE: MCD ) and Dunkin' Brands (NASDAQ: DNKN ) pushing deeper into its coffee space, Starbucks (NASDAQ: SBUX ) is set to push back. The company will be rolling out an expanded food menu soon. Fool contributor Demitrios Kalogeropoulos discusses why this makes sense for Starbucks, and what kind of boost it could give to the company's sales.

- [By Dan Caplinger]

Unfortunately, the biggest news for Yum! this quarter has been bad. An outbreak of avian flu in China has resulted in fewer customers venturing out to Yum!'s eateries in the emerging-market nation. With KFC and its other restaurants in China accounting for more than half of the company's overall sales, Yum! has already warned that the outbreak has affected its results, with same-store sales in China down a whopping 13% in March on a 16% drop at KFC. McDonald's (NYSE: MCD ) has seen some negative impact as well, but its smaller footprint in China and its less extensive reliance on chicken products has helped it avoid the full brunt of the declines. Despite Yum!'s efforts to educate consumers about its food's safety, China could keep hitting Yum!'s results for some time.

Top 10 Blue Chip Stocks To Invest In 2014: Chevron Corporation(CVX)

Chevron Corporation, through its subsidiaries, engages in petroleum, chemicals, mining, power generation, and energy operations worldwide. It operates in two segments, Upstream and Downstream. The Upstream segment involves in the exploration, development, and production of crude oil and natural gas; processing, liquefaction, transportation, and regasification associated with liquefied natural gas; transportation of crude oil through pipelines; and transportation, storage, and marketing of natural gas, as well as holds interest in a gas-to-liquids project. The Downstream segment engages in the refining of crude oil into petroleum products; marketing of crude oil and refined products primarily under the Chevron, Texaco, and Caltex brand names; transportation of crude oil and refined products by pipeline, marine vessel, motor equipment, and rail car; and manufacture and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant additives. It a lso produces and markets coal and molybdenum; and holds interests in 13 power assets with a total operating capacity of approximately 3,100 megawatts, as well as involves in cash management and debt financing activities, insurance operations, real estate activities, energy services, and alternative fuels and technology business. Chevron Corporation has a joint venture agreement with China National Petroleum Corporation. The company was formerly known as ChevronTexaco Corp. and changed its name to Chevron Corporation in May 2005. Chevron Corporation was founded in 1879 and is based in San Ramon, California.

Advisors' Opinion: - [By John Maxfield]

In terms of individual stocks, shares of Chevron (NYSE: CVX ) are headed higher in afternoon trading after the oil giant reported first-quarter earnings (link opens PDF) before the bell. While the oil giant saw its revenue and net income decline by 6.4% and 4.5%, respectively, its earnings per share managed to come in ahead of estimates. For the three months ended March 31, the company earned $3.31 per share compared to the consensus estimate of $3.09 per share. Like ExxonMobil, which reported yesterday, Chevron's top and bottom lines were the latest victims of falling global oil prices.

Top 10 Blue Chip Stocks To Invest In 2014: Colgate-Palmolive Company(CL)

Colgate-Palmolive Company, together with its subsidiaries, manufactures and markets consumer products worldwide. It offers oral care products, including toothpaste, toothbrushes, and mouth rinses, as well as dental floss and pharmaceutical products for dentists and other oral health professionals; personal care products, such as liquid hand soap, shower gels, bar soaps, deodorants, antiperspirants, shampoos, and conditioners; and home care products comprising laundry and dishwashing detergents, fabric conditioners, household cleaners, bleaches, dishwashing liquids, and oil soaps. The company offers its oral, personal, and home care products under the Colgate Total, Colgate Max Fresh, Colgate 360 Advisors' Opinion:

Top 10 Blue Chip Stocks To Invest In 2014: Visa Inc.(V)

Visa Inc., a payments technology company, engages in the operation of retail electronic payments network worldwide. It facilitates commerce through the transfer of value and information among financial institutions, merchants, consumers, businesses, and government entities. The company owns and operates VisaNet, a global processing platform that provides transaction processing services. It also offers a range of payments platforms, which enable credit, charge, deferred debit, debit, and prepaid payments, as well as cash access for consumers, businesses, and government entities. The company provides its payment platforms under the Visa, Visa Electron, PLUS, and Interlink brand names. In addition, it offers value-added services, including risk management, issuer processing, loyalty, dispute management, value-added information, and CyberSource-branded services. The company is headquartered in San Francisco, California.

Advisors' Opinion: - [By Sean Williams]

The biggest concern for the two largest credit card processing companies -- MasterCard and Visa (NYSE: V ) �-- is whether or not consumer spending is growing or slowing. If global dollars transacted and volumes are falling, that would mean less processing revenue for these giants. However, I can't actually recall the last time we saw a steady decline in credit card usage since the deep recession of 2009.

Associated Press

Associated Press

There were 14 MLP IPOs in 2007. Until this year, that was the record, but so far in 2013 there have been 15 MLP IPOs with perhaps more to come before year end. One of the more recent IPOs was Sprague Resources (NYSE: SRLP), which debuted on Oct. 25.

There were 14 MLP IPOs in 2007. Until this year, that was the record, but so far in 2013 there have been 15 MLP IPOs with perhaps more to come before year end. One of the more recent IPOs was Sprague Resources (NYSE: SRLP), which debuted on Oct. 25.