I group my equity investments into three main categories:

Compounders: These are Warren Buffett "forever" stocks, or franchise businesses with durable competitive advantages that I'm willing to hold for a long time as long as the business continues to compound cash flow, dividends, and intrinsic value.

Cheap and Good: These are stocks that are not as high quality as the compounders, but are still above average businesses producing good returns on capital but are for some reason selling at a cheap price, often because of some temporary problem. These stocks are often Joel Greenblatt style Magic Formula stocks.

Cheap Assets: These are stocks that give you the opportunity to buy $1 worth of assets at a discount. Net-nets, stocks below tangible book, or stocks with hidden asset values fall into this group. Often times the businesses in this group have problems, but the market is offering you the assets for less than the value on the books, and you get the upside potential of the business improving without paying anything for it.

Hot Warren Buffett Stocks To Own For 2014: Schawk Inc.(SGK)

Schawk, Inc., together with its subsidiaries, provides graphic services and solutions in the Americas, Europe, and the Asia Pacific. The company?s graphic services encompasses a range of creative and executional service offerings, including traditional premedia business services, as well as digital photography, color retouching, large format digital printing, and sales and promotional samples under the Schawk brand name; and digital three-dimensional modeling of prototypes or existing packages for its consumer products clients. Its brand and package strategy and design services include brand consulting and creative design for packaging applications to consumer products companies, food and beverage retailers, and mass merchandisers under the Brandimage and Anthem brands. The company also offers digital promotion and advertising services to the digital communications markets under the Untitled and Real Branding brand names. In addition, it provides software products, such a s graphic lifecycle content management systems comprising digital asset management, workflow management, online proofing, and intelligence performance management modules; and support services, which include implementation, on-site management, validation for regulated environments, and support and training for the marketing services departments of consumer products, pharmaceutical/life sciences, and retail companies. The company serves direct purchasers of graphic services, including end-use consumer product manufacturers of food, beverage, non-food and beverage, and pharmaceutical products; groceries, pharmacies, department, and mass merchant retailers; converters; and advertising agencies. Schawk, Inc. was founded in 1953 and is headquartered in Des Plaines, Illinois.

Advisors' Opinion: Hot Warren Buffett Stocks To Own For 2014: Federal Signal Corporation(FSS)

Federal Signal Corporation designs and manufactures a suite of products and integrated solutions for municipal, governmental, industrial, and commercial customers worldwide. The company operates in three segments: Safety and Security Systems, Fire Rescue, and Environmental Solutions. The Safety and Security Systems segment offers various systems for automated license plate recognition, campus and community alerting, emergency vehicles, first responder interoperable communications, industrial communications and command, municipal networked security, vehicle classification, parking revenue, and access control. This segment also provides products, such as lightbars and sirens, public warning sirens, and public safety software. The Fire Rescue segment offers articulated and telescopic aerial platforms for rescue, fire fighting, and maintenance purposes. This segment sells its products to municipal and industrial fire services, civil defense authorities, rental companies, elect ric utilities and industrial customers. The Environmental Solutions segment provides various self-propelled street cleaning vehicles, vacuum loader vehicles, municipal catch basin/sewer cleaning vacuum trucks, and water blasting equipment. The company was founded in 1901 and is based in Oak Brook, Illinois.

Advisors' Opinion: - [By Rich Smith]

Oak Brook, Ill.-based Federal Signal (NYSE: FSS ) will soon have a new chief financial officer, the company announced yesterday.

On Friday, the diversified manufacturer named Brian S. Cooper�to replace interim CFO Braden Waverley on May 28. Waverly will remain acting CFO until Cooper joins the company next month. Cooper comes to Federal Signal by way of smaller telecommunications equipment maker Westell Technologies (NASDAQ: WSTL ) , where he has served as CFO since 2009.

Konami Corporation develops, publishes, markets, and distributes video game software products for stationary and portable consoles, as well as for use on personal computers. It operates in four segments: Digital Entertainment, Gaming & Systems, Pachinko & Pachinko Slot Machines, and Health & Fitness. The Digital Entertainment segment offers video game software, social games for social networking services Web sites, content for mobile phones and token-operated games, online games, music and video package products, video games for amusement facilities, and card games, as well as electronic toys, figures, and character goods. This segment also builds computer systems related to online games, maintains and operates online servers, and purchases and distributes video game software for home use. The Gaming & Systems segment develops and sells content, hardware, and casino management systems for gaming machines for casinos. The Pachinko & Pachinko Slot Machines segment involves i n the production, manufacture and sale of pachinko slot machines and liquid crystal displays for pachinko machines. The Health & Fitness segment operates health and fitness clubs. As of March 31, 2011, this segment had a network of 208 directly operated health and fitness club facilities; and 152 sports facilities whose operations are outsourced to it. The company sells its products primarily in Japan, North America, Europe, Australia, and the rest of Asia. Konami Corporation was founded in 1969 and is headquartered in Tokyo, Japan.

Hot Warren Buffett Stocks To Own For 2014: Bank of Marin Bancorp(BMRC)

Bank of Marin Bancorp operates as the bank holding company for Bank of Marin that offers a range of commercial and retail banking products and services in California. It offers personal and business checking and savings accounts; time deposit alternatives comprising time certificates of deposit, individual retirement accounts, health savings accounts, and certificate of deposit account registry services; remote deposit capture, direct deposit of payroll, social security and pension checks, fraud prevention services, and image lockbox services; and valet deposit pick-up service. The company provides its deposit products and services primarily to individuals, merchants, small to medium sized businesses, not-for-profit organizations, and professionals. Its loan portfolio comprises commercial and retail lending programs that include commercial loans and lines of credit, construction financing, consumer loans, and home equity lines of credit. In addition, the company provides m erchant card services, credit cards, and business Visa programs; cash management services to business clients through a third party vendor; wealth management and trust services, such as customized investment portfolio management, financial planning, trust administration, estate settlement and custody services, and advice on charitable giving; and 401(k) plan services to small and medium businesses through a third party vendor. Further, it provides private banking services, including deposit services and loans; international banking services; and automated teller machine, Internet banking, and telephone banking services. As of April 25, 2011, Bank of Marin Bancorp operated 17 branch offices in Marin, San Francisco, Napa, and Sonoma counties. The company was founded in 1989 and is headquartered in Novato, California.

Hot Warren Buffett Stocks To Own For 2014: Saunders International Ltd(SND.AX)

Saunders International Limited designs, constructs, and maintains steel bulk liquid storage tanks and reservoirs in Australia. It constructs water reservoirs and petroleum tanks, as well as acid, bitumen, and chemical tanks. The company also offers facilities maintenance services, including risk based maintenance prioritizing, QA compliant inspection, decommissioning and recommissioning, in-house engineering analysis and workshop fabrication, mechanical repair, and preventative maintenance services. In addition, it provides steel fabrication services, which consists of rolling, pressing, abrasive blasting, and painting. The company offers its products to companies operating in petroleum, mining, mineral processing, manufacturing, water, and waste water sectors. Saunders International Limited was founded in 1951 and is headquartered in Condell Park, Australia.

Hot Warren Buffett Stocks To Own For 2014: Skyepharma(SKP.L)

SkyePharma PLC engages in the research and development, manufacture, and sale of prescription pharmaceutical products worldwide. It offers Pulmicort PMDI, a hydrofluoroalkane metered dose inhaler for the treatment of asthma; and Solaraze, a topical gel treatment for actinic keratosis. The company?s oral products consist of Sular, a calcium channel blocker antihypertensive therapy; Triglide, an oral fibrate that reduces elevated plasma concentrations of triglycerides; Lodotra, an anti-inflammatory drug for treating the pain and stiffness caused by rheumatoid arthritis; Paxil Controlled Release, a selective serotonin reuptake inhibitor antidepressant; Xatral OD/Uroxatral, a selective alpha-blocker for treating the urinary symptoms of benign prostatic hyperplasia; Coruno for the oral treatment of chronic angina pectoris; Madopar Dual Release, which is indicated for the oral treatment of various forms of the Parkinson disease; diclofenac-ratiopharm uno for pain and inflammati on treatment; ZYFLO CR, a leukotriene synthesis inhibitor oral anti-inflammatory asthma drug; and Requip XL, a once daily formulation for Parkinson?s disease. Its inhalation pipeline products include Flutiform, which completed Phase-III clinical trials for the treatment of asthma; and Flutiform that is in Phase-III clinical trials for the treatment of asthma. The company?s oral pipeline products comprise Lodotra, which is in Phase-III clinical trials for the treatment of rheumatoid arthritis; SKP-1041 that is in Phase-II clinical trials for the treatment of sleep maintenance; and SKP-1052, which is in Phase-I clinical trial for the treatment of diabetes. The company was founded in 1910 and is headquartered in London, the United Kingdom.

Hot Warren Buffett Stocks To Own For 2014: WesBanco Inc.(WSBC)

WesBanco, Inc. operates as a holding company for WesBanco Bank, Inc. that provides various financial products and services. It engages in generating deposits and originating loans. The company?s deposit products include interest bearing demand deposits, money market accounts, savings deposits, and certificate of deposits. Its loan portfolio comprises commercial real estate loans; commercial and industrial loans; residential real estate loans that consist of loans to purchase, construct, or refinance personal residences, including one-to-four family rental properties; home equity lines of credit; and consumer loans comprising of installment loans to finance purchases of automobiles, motorcycles, boats, and other recreational vehicles, and lines of credit. The company, through its other subsidiaries, also offers property, casualty, and life insurance, as well as benefit plan sales and administration for personal and commercial clients; and discount brokerage and asset manag ement services. In addition, it provides trust services and various investment products, including mutual funds, as well as engages in leasing commercial real estate properties. As of February 26, 2010, the company operated 114 branch locations and 138 automated teller machines in West Virginia, Ohio, and Pennsylvania. The company was founded in 1968 and is headquartered in Wheeling, West Virginia.

Advisors' Opinion: - [By WWW.GURUFOCUS.COM]

WesBanco Inc. (WSBC) operates as a holding company for WesBanco Bank Inc. that provides retail banking, corporate banking, personal and corporate trust services, and mortgage banking and insurance services. Aug. 22, the company increased its quarterly dividend 5.3% to $0.20 per share. The dividend is payable Oct. 1, 2013 to shareholders of record on Sept. 13, 2013. The yield based on the new payout is 2.6%.

Hot Warren Buffett Stocks To Own For 2014: Jack Henry & Associates Inc.(JKHY)

Jack Henry & Associates, Inc. (JHA) provides integrated computer systems and services for in-house and outsourced data processing to commercial banks, credit unions, and other financial institutions primarily in the United States. It engages in processing transactions, automating business processes, and managing information services. The company?s Jack Henry Banking brand provides integrated data processing systems to de novo or start-up institutions and mid-tier banks, as well as markets three core banking software systems, such as SilverLake, a robust IBM i-based system designed for commercial-focused banks; CIF 20/20, a parameter-driven and easy-to-use system; and Core Director, a Windows-based and client/server system that offers intuitive point-and-click operation. Its Symitar brand supports credit unions with information and transaction processing platforms that provide enterprise-wide automation. This brand?s solutions include Episys, a robust IBM p-based system p rimarily designed for credit unions; and Cruise, a Windows-based and client/server system for credit unions. The company?s ProfitStars brand provides specialized products and services that enhance the performance of financial service organizations and corporate entities. Its iPay Technologies brand operates as an electronic bill pay for banks and credit unions with turnkey, and configurable retail and small business electronic payment platforms. JHA also offers complementary solutions comprising business intelligence and bank management, retail and business banking, member and member business services, Internet banking and electronic funds transfer, risk management and protection, and item and document imaging solutions. In addition, it provides data conversion, software implementation, training, and support services, as well as sells hardware systems. The company has strategic relationship with IBM Corporation. JHA was founded in 1969 and is based in Monett, Missouri.

Advisors' Opinion: - [By Jay Jenkins]

For U.S. Bancorp, a fine of this magnitude is nothing more than a slap on the wrist. However, it is a harbinger for change in how regulators view third-party relationships. Banks will now have to think long and hard about outsourcing, even to reputable companies like Jack Henry and Associates (NASDAQ: JKHY ) and Fiserv (NASDAQ: FISV ) .�

- [By Seth Jayson]

Margins matter. The more Jack Henry & Associates (Nasdaq: JKHY ) keeps of each buck it earns in revenue, the more money it has to invest in growth, fund new strategic plans, or (gasp!) distribute to shareholders. Healthy margins often separate pretenders from the best stocks in the market. That's why we check up on margins at least once a quarter in this series. I'm looking for the absolute numbers, so I can compare them to current and potential competitors, and any trend that may tell me how strong Jack Henry & Associates's competitive position could be.

Bloomberg News

Bloomberg News

Fall is always a welcome change of pace for most people after a long, hot summer. It brings relief not only from the temperatures, but at the gasoline pump as well. Pundits frequently notice this phenomenon during election years, and assume that vested interests are trying to manipulate prices to win elections. But there is a more straightforward explanation to what’s going on, and it can benefit consumers, LNG producers, and sometimes refiners.

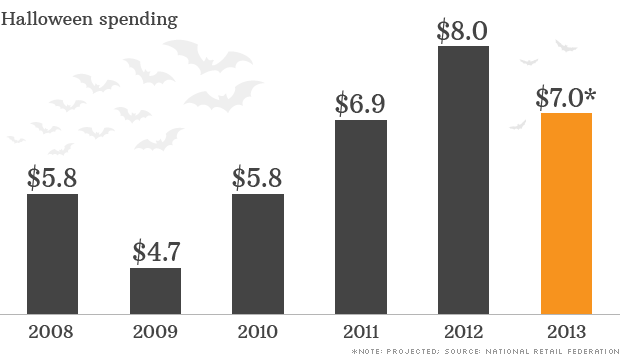

Fall is always a welcome change of pace for most people after a long, hot summer. It brings relief not only from the temperatures, but at the gasoline pump as well. Pundits frequently notice this phenomenon during election years, and assume that vested interests are trying to manipulate prices to win elections. But there is a more straightforward explanation to what’s going on, and it can benefit consumers, LNG producers, and sometimes refiners. NEW YORK (CNNMoney) Consumers are spooked this Halloween -- and it's not just the ghosts, goblins, and ghouls.

NEW YORK (CNNMoney) Consumers are spooked this Halloween -- and it's not just the ghosts, goblins, and ghouls.  A Hyundai for the zombie apocalypse

A Hyundai for the zombie apocalypse  U.S. trio awarded Nobel Prize for Economics

U.S. trio awarded Nobel Prize for Economics  Bloomberg

Bloomberg