The aerospace industry has received another blow with the crash of an Eurocopter AS350 in Seattle, on March 18. However, the episode had no repercussions on the stock market. As a matter of fact, Eurcopter's parent company, Airbus Group (EADSY), saw a sudden stock price increment. This counter intuitive phenomenon has many explanations. Most interestingly, it seems to point at a certain weakness on the part of competitors. In other words, competitors are expected to acquire an advantage from each other's mishaps. This particular incident challenges common knowledge and offers a good excuse to see what and how are Airbus Group's competitors performing. In this opportunity, I would like to take a look at Textron (TXT).

Acquiring Businesses, Keeping Promises and Testing New Products

The latest acquisition by Textron is Beechcraft for an estimated sum of $1.5 billion. The deal includes the type certificates to the out-of-production Hawker 4000 and Premier IA, plus support organization Hawker Beechcraft Services. Besides completing the transaction announced late last year, the company made public the merger of Cessna, Beechcraft and Hawker into a new Textron Aviation business. "Uniting these brands creates a robust industry competitor, operating as one team with a common goal to serve customers everywhere our aircraft fly," said Textron Chairman and CEO Scott Donnelly.

Another important announcement for the long term made by Textron concerns the $45 million incentive agreement the company signed with state and local governments in 2010. "We have spoken with state officials. Nothing is changing with the agreement at this time," Beechcraft spokesperson Nicole Alexander said. Questions have risen due to the merger that implies a change on the employer count. Hence, the firm is at least enticed to keep the absorbed worked force stable in order to secure the $5 million stipulated in the agreement with state officials.

Strengthening portfolio and business stability is to be reinforced by the introduction of new products. Last December, Textron announced the successful first flight of the Scorpion Intelligence, Surveillance and Reconnaissance (ISR)/Strike aircraft. "The Scorpion compares very favorably to more costly aircraft currently used for low-threat missions," pilot Dan Hinson said. The new product is expected to accommodate the budget constraints and shifting mission requirements of the US Department of Defense. The same department has granted the firm an additional contract worth $22.5 million to "deprocess" Mobile Strike Force vehicles and train the Afghan Army.

Why Did Gurus Increase Positions?

The impact of new product introductions by Textron on overall performance has been estimated by analysts at Zacks to roam around 18.5%. In addition to the Scorpion model, the Citation X, together with the Latitude and Longitude platforms are expected to hit the market between 2014 and 2017. Most importantly, the firm continues to dedicate time at improving its operational execution and cost productivity. This will guarantee operational margins, improving steadily since 2009.

An important characteristic to Textron is diversified at two levels: geography and segment. The firm's geographically diverse network of aircraft, defense and intelligence, industrial and finance businesses negates any specific business risk. That has been a key in the recovery seen since the last economic crisis. Hence, debt has been slashed to a third while revenue and net income improve yearly.

Trading at 22 times its trailing earnings, Textron's stock carries a 15% premium to the industry average. Also, the stock price is recovering the ground lost during the first half of March. This loss is small when compared to the rise in stock price registered throughout the second half of 2013. Their stock purchases confirm the strong growth prospects deposited in the firm. Given that the stock price is not expected to fall this may be one of the last opportunities to start a long-term investment for a while.

Disclosure: Vanina Egea holds no position in any of the mentioned stocks.

About the author:Vanina EgeaA fundamental analyst at Lone Tree Analytics

Visit Vanina Egea's Website

| Currently 5.00/512345 Rating: 5.0/5 (2 votes) | Voters:  |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

TXT STOCK PRICE CHART

38.56 (1y: +24%) $(function(){var seriesOptions=[],yAxisOptions=[],name='TXT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363755600000,31.21],[1363842000000,30.71],[1363928400000,30.75],[1364187600000,29.69],[1364274000000,29.86],[1364360400000,29.5],[1364446800000,29.81],[1364792400000,29.19],[1364878800000,28.77],[1364965200000,28.52],[1365051600000,28.79],[1365138000000,28.56],[1365397200000,28.97],[1365483600000,28.68],[1365570000000,29.14],[1365656400000,29.94],[1365742800000,29.81],[1366002000000,28.48],[1366088400000,29.35],[1366174800000,25.41],[1366261200000,25.76],[1366347600000,26.35],[1366606800000,25.78],[1366693200000,25.72],[1366779600000,25.76],[1366866000000,26.18],[1366952400000,26.06],[1367211600000,26.14],[1367298000000,25.75],[1367384400000,24.88],[1367470800000,25.57],[1367557200000,25.72],[1367816400000,26.76],[1367902800000,26.9],[1367989200000,26.73],[1368075600000,27.04],[1368162000000,27.13],[1368421200000,27.15],[1368507600000,27.32],[1368594000000,27.61],[1368680400000,27.6],[1368766800000,28.25],[1369026000000,28.2],[1369112400000,28.09],[1369198800000,27.28],[1369285200000,27.15],[1369371600000,27.51],[1369717200000,27.8],[1369803600000,26.94],[1369890000000,27.32],[1369976400000,26.96],[1370235600000,26.83],[1370322000000,26.46],[1370408400000,25.74],[1370494800000,26.47],[1370581200000,26.92],[1370840400000,26.91],[1370926800000,26.65],[1371013200000,26.12],[1371099600000,26.6],[1371186000000,26.5],[1371445200000,27.09],[1371531600000,27.18],[1371618000000,26.9],[1371704400000,26.09],[1371790800000,25.9],[1372050000000,25.27],[1372136400000,25.39],[1372222800000,25.77],[1372309200000,26.38],[1372395600000,26.05],[1372654800000,26.18],[1372741200000,25.62],[1372827600000,25.64],[1373000400000,26.24],[1373259600000,26.31],[1373346000000,26.89],[1373432400000,27.28],[1373518800000,27.74],[1373605200000,27.64],[1373864400000,27.72],[1373950800000,27.73],[1374037200000,27.74],[1374123600000,28.27],[1374210000000,28.54],[1374469200000,28.96],[1374555600000,28.91],[137! 4642000000,27.92],[1374728400000,27.83],[1374814800000,27.59],[1375074000000,27.65],[1375160400000,27.67],[1375246800000,27.38],[1375333200000,28.6],[1375419600000,28.73],[1375678800000,28.98],[1375765200000,28.46],[1375851600000,28.17],[1375938000000,28.21],[1376024400000,28],[1376283600000,27.71],[1376370000000,28.76],[1376456400000,28.31],[1376542800000,27.86],[1376629200000,27.6],[1376888400000,27.25],[1376974800000,27.2],[1377061200000,27.26],[1377147600000,27.55],[1377234000000,27.75],[1377493200000,27.61],[1377579600000,26.65],[1377666000000,26.81],[1377752400000,27.41],[1377838800000,26.94],[1378184400000,27.28],[1378270800000,27.55],[1378357200000,28.06],[1378443600000,28.17],[1378702800000,28.96],[1378789200000,29.5],[1378875600000,29.38],[1378962000000,28.43],[1379048400000,28.67],[1379307600000,29.05],[1379394000000,29.35],[1379480400000,29.31],[1379566800000,29],[1379653200000,28.47],[1379912400000,28.21],[1379998800000,28.28],[1380085200000,27.89],[1380171600000,27.94],[1380258000000,27.9],[1380517200000,27.61],[1380603600000,27.87],[1380690000000,27.63],[1380776400000,27.1],[1380862800000,27.12],[1381122000000,26.88],[1381208400000,26.6],[1381294800000,26.46],[1381381200000,27.26],[1381467600000,27.31],[1381726800000,27.29],[1381813200000,26.67],[1381899600000,27.06],[1381986000000,27.52],[1382072400000,28.25],[1382331600000,28.18],[1382418000000,28.41],[1382504400000,28.51],[1382590800000,29.04],[1382677200000,29.07],[1382936400000,29.04],[1383022800000,29.12],[1383109200000,28.99],[1383195600000,28.79],[1383282000000,29],[1383544800000,29.46],[1383631200000,29.1],[1383717600000,29.45],[1383804000000,29.38],[1383890400000,30.28],[1384149600000,30.34],[1384236000000,30.67],[1384322400000,31.08],[1384408800000,30.67],[1384495200000,30.65],[1384754400000,30.67],[1384840800000,30.4],[1384927200000,30.51],[1385013600000,31.51],[1385100000000,31.98],[1385359200000,32.71],[1385445600000,32.77],[1385532000000,33.25],[1385704800000,33.23],[1385964000000,33.12],[1386050400000,32.63],[1386136800000! ,32.26],[! 1386223200000,32.3],[1386309600000,32.62],[1386568800000,32.41],[1386655200000,32.24],[1386741600000,31.59],[1386828000000,31.51],[1386914400000,31.46],[1387173600000,32.11],[1387260000000,32.1],[1387346400000,32.79],[1387432800000,32.57],[1387519200000,37.29],[1387778400000,36.38],[138786

But the market reaction was clear. Barclays' share price lost 6% yesterday. The Financial Times calculates that more than $13 billion was wiped off the market value of the 10 biggest dark pool owners (others include Credit Suisse, UBS and Deutsche Bank). The FT also claims that big banks have started to pull business out of Barclays' dark pool – this is the subject of today's front page – and one doesn't have to have the most photographic memory of the financial crisis to recall what happens when funds start being pulled out when confidence fails in an institution.

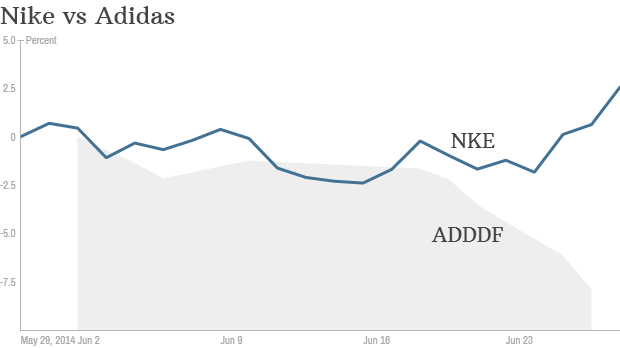

But the market reaction was clear. Barclays' share price lost 6% yesterday. The Financial Times calculates that more than $13 billion was wiped off the market value of the 10 biggest dark pool owners (others include Credit Suisse, UBS and Deutsche Bank). The FT also claims that big banks have started to pull business out of Barclays' dark pool – this is the subject of today's front page – and one doesn't have to have the most photographic memory of the financial crisis to recall what happens when funds start being pulled out when confidence fails in an institution. Nike 1, Adidas 0 NEW YORK (CNNMoney) The World Cup is not just a battle for soccer supremacy. It's also a showdown between two global brands: Nike and Adidas.

Nike 1, Adidas 0 NEW YORK (CNNMoney) The World Cup is not just a battle for soccer supremacy. It's also a showdown between two global brands: Nike and Adidas.  World Cup retail is Christmas in June

World Cup retail is Christmas in June

Popular Posts: Don't Tread on Me – 3 Great All-American Dividend Stocks to Buy3 Things That Could Get Amazon Stock Popping AgainThe Top 10 S&P 500 Dividend Stocks for March Recent Posts: Don’t Buy the Sucker’s Rally in 3D Printing Companies Spiking Oil Prices, Rising Energy Stocks Are Headed for a Fall Oracle Stock a Buy on the Dip After Earnings View All Posts Don’t Buy the Sucker’s Rally in 3D Printing Companies

Popular Posts: Don't Tread on Me – 3 Great All-American Dividend Stocks to Buy3 Things That Could Get Amazon Stock Popping AgainThe Top 10 S&P 500 Dividend Stocks for March Recent Posts: Don’t Buy the Sucker’s Rally in 3D Printing Companies Spiking Oil Prices, Rising Energy Stocks Are Headed for a Fall Oracle Stock a Buy on the Dip After Earnings View All Posts Don’t Buy the Sucker’s Rally in 3D Printing Companies  3D printing companies represent an exciting new technology — in its very early stages. That has names like DDD stock, XONE stock and SSYS stock running on momentum, where ever-accelerating revenue growth — and hope and hype — supports the share price more than the bottom line.

3D printing companies represent an exciting new technology — in its very early stages. That has names like DDD stock, XONE stock and SSYS stock running on momentum, where ever-accelerating revenue growth — and hope and hype — supports the share price more than the bottom line. Bloomberg News

Bloomberg News

38.56 (1y: +24%) $(function(){var seriesOptions=[],yAxisOptions=[],name='TXT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363755600000,31.21],[1363842000000,30.71],[1363928400000,30.75],[1364187600000,29.69],[1364274000000,29.86],[1364360400000,29.5],[1364446800000,29.81],[1364792400000,29.19],[1364878800000,28.77],[1364965200000,28.52],[1365051600000,28.79],[1365138000000,28.56],[1365397200000,28.97],[1365483600000,28.68],[1365570000000,29.14],[1365656400000,29.94],[1365742800000,29.81],[1366002000000,28.48],[1366088400000,29.35],[1366174800000,25.41],[1366261200000,25.76],[1366347600000,26.35],[1366606800000,25.78],[1366693200000,25.72],[1366779600000,25.76],[1366866000000,26.18],[1366952400000,26.06],[1367211600000,26.14],[1367298000000,25.75],[1367384400000,24.88],[1367470800000,25.57],[1367557200000,25.72],[1367816400000,26.76],[1367902800000,26.9],[1367989200000,26.73],[1368075600000,27.04],[1368162000000,27.13],[1368421200000,27.15],[1368507600000,27.32],[1368594000000,27.61],[1368680400000,27.6],[1368766800000,28.25],[1369026000000,28.2],[1369112400000,28.09],[1369198800000,27.28],[1369285200000,27.15],[1369371600000,27.51],[1369717200000,27.8],[1369803600000,26.94],[1369890000000,27.32],[1369976400000,26.96],[1370235600000,26.83],[1370322000000,26.46],[1370408400000,25.74],[1370494800000,26.47],[1370581200000,26.92],[1370840400000,26.91],[1370926800000,26.65],[1371013200000,26.12],[1371099600000,26.6],[1371186000000,26.5],[1371445200000,27.09],[1371531600000,27.18],[1371618000000,26.9],[1371704400000,26.09],[1371790800000,25.9],[1372050000000,25.27],[1372136400000,25.39],[1372222800000,25.77],[1372309200000,26.38],[1372395600000,26.05],[1372654800000,26.18],[1372741200000,25.62],[1372827600000,25.64],[1373000400000,26.24],[1373259600000,26.31],[1373346000000,26.89],[1373432400000,27.28],[1373518800000,27.74],[1373605200000,27.64],[1373864400000,27.72],[1373950800000,27.73],[1374037200000,27.74],[1374123600000,28.27],[1374210000000,28.54],[1374469200000,28.96],[1374555600000,28.91],[137! 4642000000,27.92],[1374728400000,27.83],[1374814800000,27.59],[1375074000000,27.65],[1375160400000,27.67],[1375246800000,27.38],[1375333200000,28.6],[1375419600000,28.73],[1375678800000,28.98],[1375765200000,28.46],[1375851600000,28.17],[1375938000000,28.21],[1376024400000,28],[1376283600000,27.71],[1376370000000,28.76],[1376456400000,28.31],[1376542800000,27.86],[1376629200000,27.6],[1376888400000,27.25],[1376974800000,27.2],[1377061200000,27.26],[1377147600000,27.55],[1377234000000,27.75],[1377493200000,27.61],[1377579600000,26.65],[1377666000000,26.81],[1377752400000,27.41],[1377838800000,26.94],[1378184400000,27.28],[1378270800000,27.55],[1378357200000,28.06],[1378443600000,28.17],[1378702800000,28.96],[1378789200000,29.5],[1378875600000,29.38],[1378962000000,28.43],[1379048400000,28.67],[1379307600000,29.05],[1379394000000,29.35],[1379480400000,29.31],[1379566800000,29],[1379653200000,28.47],[1379912400000,28.21],[1379998800000,28.28],[1380085200000,27.89],[1380171600000,27.94],[1380258000000,27.9],[1380517200000,27.61],[1380603600000,27.87],[1380690000000,27.63],[1380776400000,27.1],[1380862800000,27.12],[1381122000000,26.88],[1381208400000,26.6],[1381294800000,26.46],[1381381200000,27.26],[1381467600000,27.31],[1381726800000,27.29],[1381813200000,26.67],[1381899600000,27.06],[1381986000000,27.52],[1382072400000,28.25],[1382331600000,28.18],[1382418000000,28.41],[1382504400000,28.51],[1382590800000,29.04],[1382677200000,29.07],[1382936400000,29.04],[1383022800000,29.12],[1383109200000,28.99],[1383195600000,28.79],[1383282000000,29],[1383544800000,29.46],[1383631200000,29.1],[1383717600000,29.45],[1383804000000,29.38],[1383890400000,30.28],[1384149600000,30.34],[1384236000000,30.67],[1384322400000,31.08],[1384408800000,30.67],[1384495200000,30.65],[1384754400000,30.67],[1384840800000,30.4],[1384927200000,30.51],[1385013600000,31.51],[1385100000000,31.98],[1385359200000,32.71],[1385445600000,32.77],[1385532000000,33.25],[1385704800000,33.23],[1385964000000,33.12],[1386050400000,32.63],[1386136800000! ,32.26],[! 1386223200000,32.3],[1386309600000,32.62],[1386568800000,32.41],[1386655200000,32.24],[1386741600000,31.59],[1386828000000,31.51],[1386914400000,31.46],[1387173600000,32.11],[1387260000000,32.1],[1387346400000,32.79],[1387432800000,32.57],[1387519200000,37.29],[1387778400000,36.38],[138786

38.56 (1y: +24%) $(function(){var seriesOptions=[],yAxisOptions=[],name='TXT',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1363755600000,31.21],[1363842000000,30.71],[1363928400000,30.75],[1364187600000,29.69],[1364274000000,29.86],[1364360400000,29.5],[1364446800000,29.81],[1364792400000,29.19],[1364878800000,28.77],[1364965200000,28.52],[1365051600000,28.79],[1365138000000,28.56],[1365397200000,28.97],[1365483600000,28.68],[1365570000000,29.14],[1365656400000,29.94],[1365742800000,29.81],[1366002000000,28.48],[1366088400000,29.35],[1366174800000,25.41],[1366261200000,25.76],[1366347600000,26.35],[1366606800000,25.78],[1366693200000,25.72],[1366779600000,25.76],[1366866000000,26.18],[1366952400000,26.06],[1367211600000,26.14],[1367298000000,25.75],[1367384400000,24.88],[1367470800000,25.57],[1367557200000,25.72],[1367816400000,26.76],[1367902800000,26.9],[1367989200000,26.73],[1368075600000,27.04],[1368162000000,27.13],[1368421200000,27.15],[1368507600000,27.32],[1368594000000,27.61],[1368680400000,27.6],[1368766800000,28.25],[1369026000000,28.2],[1369112400000,28.09],[1369198800000,27.28],[1369285200000,27.15],[1369371600000,27.51],[1369717200000,27.8],[1369803600000,26.94],[1369890000000,27.32],[1369976400000,26.96],[1370235600000,26.83],[1370322000000,26.46],[1370408400000,25.74],[1370494800000,26.47],[1370581200000,26.92],[1370840400000,26.91],[1370926800000,26.65],[1371013200000,26.12],[1371099600000,26.6],[1371186000000,26.5],[1371445200000,27.09],[1371531600000,27.18],[1371618000000,26.9],[1371704400000,26.09],[1371790800000,25.9],[1372050000000,25.27],[1372136400000,25.39],[1372222800000,25.77],[1372309200000,26.38],[1372395600000,26.05],[1372654800000,26.18],[1372741200000,25.62],[1372827600000,25.64],[1373000400000,26.24],[1373259600000,26.31],[1373346000000,26.89],[1373432400000,27.28],[1373518800000,27.74],[1373605200000,27.64],[1373864400000,27.72],[1373950800000,27.73],[1374037200000,27.74],[1374123600000,28.27],[1374210000000,28.54],[1374469200000,28.96],[1374555600000,28.91],[137! 4642000000,27.92],[1374728400000,27.83],[1374814800000,27.59],[1375074000000,27.65],[1375160400000,27.67],[1375246800000,27.38],[1375333200000,28.6],[1375419600000,28.73],[1375678800000,28.98],[1375765200000,28.46],[1375851600000,28.17],[1375938000000,28.21],[1376024400000,28],[1376283600000,27.71],[1376370000000,28.76],[1376456400000,28.31],[1376542800000,27.86],[1376629200000,27.6],[1376888400000,27.25],[1376974800000,27.2],[1377061200000,27.26],[1377147600000,27.55],[1377234000000,27.75],[1377493200000,27.61],[1377579600000,26.65],[1377666000000,26.81],[1377752400000,27.41],[1377838800000,26.94],[1378184400000,27.28],[1378270800000,27.55],[1378357200000,28.06],[1378443600000,28.17],[1378702800000,28.96],[1378789200000,29.5],[1378875600000,29.38],[1378962000000,28.43],[1379048400000,28.67],[1379307600000,29.05],[1379394000000,29.35],[1379480400000,29.31],[1379566800000,29],[1379653200000,28.47],[1379912400000,28.21],[1379998800000,28.28],[1380085200000,27.89],[1380171600000,27.94],[1380258000000,27.9],[1380517200000,27.61],[1380603600000,27.87],[1380690000000,27.63],[1380776400000,27.1],[1380862800000,27.12],[1381122000000,26.88],[1381208400000,26.6],[1381294800000,26.46],[1381381200000,27.26],[1381467600000,27.31],[1381726800000,27.29],[1381813200000,26.67],[1381899600000,27.06],[1381986000000,27.52],[1382072400000,28.25],[1382331600000,28.18],[1382418000000,28.41],[1382504400000,28.51],[1382590800000,29.04],[1382677200000,29.07],[1382936400000,29.04],[1383022800000,29.12],[1383109200000,28.99],[1383195600000,28.79],[1383282000000,29],[1383544800000,29.46],[1383631200000,29.1],[1383717600000,29.45],[1383804000000,29.38],[1383890400000,30.28],[1384149600000,30.34],[1384236000000,30.67],[1384322400000,31.08],[1384408800000,30.67],[1384495200000,30.65],[1384754400000,30.67],[1384840800000,30.4],[1384927200000,30.51],[1385013600000,31.51],[1385100000000,31.98],[1385359200000,32.71],[1385445600000,32.77],[1385532000000,33.25],[1385704800000,33.23],[1385964000000,33.12],[1386050400000,32.63],[1386136800000! ,32.26],[! 1386223200000,32.3],[1386309600000,32.62],[1386568800000,32.41],[1386655200000,32.24],[1386741600000,31.59],[1386828000000,31.51],[1386914400000,31.46],[1387173600000,32.11],[1387260000000,32.1],[1387346400000,32.79],[1387432800000,32.57],[1387519200000,37.29],[1387778400000,36.38],[138786

A tall latte will cost between 15 and 20 cents more after Tuesday. NEW YORK (CNNMoney) Your Starbucks latte could cost you more starting Tuesday, when the company raises the price of some of its drinks.

A tall latte will cost between 15 and 20 cents more after Tuesday. NEW YORK (CNNMoney) Your Starbucks latte could cost you more starting Tuesday, when the company raises the price of some of its drinks.  Starbucks CEO: $15 min. wage may kill jobs

Starbucks CEO: $15 min. wage may kill jobs

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  Lawmakers grill GM's Barra in D.C. NEW YORK (CNNMoney) Mary Barra had a tough time Wednesday convincing Congress that General Motors is changing fast enough to make safer cars.

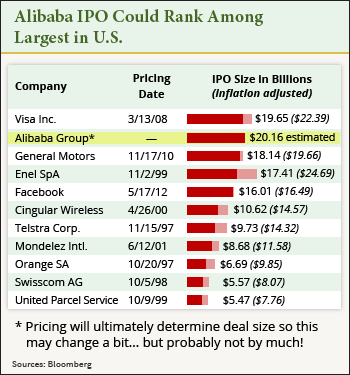

Lawmakers grill GM's Barra in D.C. NEW YORK (CNNMoney) Mary Barra had a tough time Wednesday convincing Congress that General Motors is changing fast enough to make safer cars.  Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

Some reports indicate that the Alibaba IPO date could be scheduled for the first week in August, but no official date has been set.

) will be the exclusive carrier of Amazon’s new smartphone.

) will be the exclusive carrier of Amazon’s new smartphone. Popular Posts: 10 Best “Strong Buy” Stocks — GMK GAME DAL and moreHottest Healthcare Stocks Now – IDIX MNKD ALNY CLDXHottest Technology Stocks Now – SYNA INFY GTAT GME Recent Posts: Hottest Energy Stocks Now – HK FGP LGCY KEG Hottest Healthcare Stocks Now – SHPG NKTR MWIV THC Biggest Movers in Financial Stocks Now – AEL FFG OZRK GHL View All Posts 5 Stocks With Great Operating Margin Growth — AMAT RP PHM OSTK INOC

Popular Posts: 10 Best “Strong Buy” Stocks — GMK GAME DAL and moreHottest Healthcare Stocks Now – IDIX MNKD ALNY CLDXHottest Technology Stocks Now – SYNA INFY GTAT GME Recent Posts: Hottest Energy Stocks Now – HK FGP LGCY KEG Hottest Healthcare Stocks Now – SHPG NKTR MWIV THC Biggest Movers in Financial Stocks Now – AEL FFG OZRK GHL View All Posts 5 Stocks With Great Operating Margin Growth — AMAT RP PHM OSTK INOC